I recently met with my financial advisor and our discussion sparked an idea for this post. I am going to discuss the business cycle and how as entrepreneurs we can better position ourselves to take advantage of the phase changes.

The Business Cycle

As you know there is an ebb and flow to our economy with times of prosperity and times of poverty. If you are not aware of this you need to open your eyes. The big thing to note however is that the cycle is just that, a cycle. No time of prosperity or poverty ever lasts forever. What does this mean for you and I? It means there are continual opportunities to position yourself and your business to make a profit. This is the strategy my advisor and I are following with my portfolio. The cycle can be thought of as the following a Sine wave;

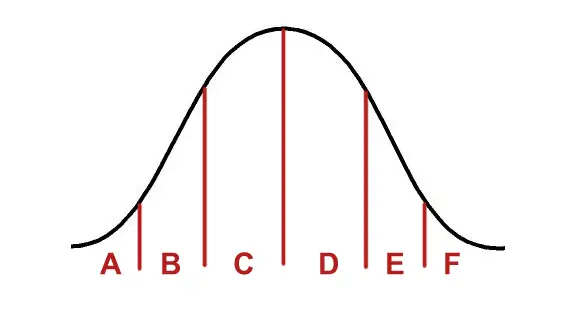

This isn’t entirely true of course but it does illustrate the general rise and fall. The common approach is to break the cycle into four parts: Recovery, Prosperity, Recession, and Depression but, for the sake of this article I have broken the cycle into 6 parts. The image below breaks the cycle into 6 parts each found between inflection points. The idea here is that the inflection point denotes the beginning of a change. “A” represents the recovery phase, “B” is growth, “C” indicates maturity, “D” can be considered to be a correction, “E” is decline, and “F” the beginning of the next recovery. This cycle as I said is not perfect but has roughly a 2-3 period.

Why should you care? Just as an investor will change his portfolio for the coming economic land scape you can position yourself accordingly. For example companies that do well in recovery are generally smaller firms that assist in efficiencies. Doing more with less is the name of the game in recovery. IT businesses can find themselves in this group as IT products often allow for higher internal efficiencies.

In the maturity phase (C) the companies that do well are the larger institutions that are less effected by the market landscape. These companies are often so big and so diversified that they never see large spikes in any regard. The law of averages keeps them on a steady path. For the entrepreneur this could mean moving away from the “want” areas of your industry and into the “need” areas. What is it that your customers absolutely cannot live without? How can you offer solutions that don’t focus on options but feed into the core need of a person or business.

The time to position yourself or your company for each change is in the preceding phase. This will often be in the growth (B) and decline (E) periods. Some of you run businesses that can be easily tailored to these changes while others of you do not. Service based organizations can alter their packages to offer a better angle on the market whereas product oriented businesses may need to diversify their product line. Again, your specific industry and circumstance will need to be taken into consideration.

Other Cycles

Cycles are everywhere and if you are aware of them you can often profit greatly. Annual cycles that affect many industries are often tied to the weather. Construction for example often slows in the winter because of the snow fall in cooler climates. The warmth of summer is also a catalyst for the soft serve beverage establishments. In fact, because I live in a 4 season area I decided against opening a self-serve yogurt shop in 2008. I watched a few similar establishments go under because they couldn’t carry an overhead through the winter months. If I were to have moved forward I would have had to offer more than frozen yogurt and I didn’t want to go down that path.

It would also be advisable to change your buying habits such that you purchase items in their off season. I haven’t tried the following but I have often wondered how much money one could make if they simply purchased lawnmowers in the winter from Craig’s list and sold them in the summer. The same could be done for snow blowers, picking them up in the summer and liquidating them in the winter. Doing this would exploit the cyclical nature of the demand that follows the weather. Of course this would require you to hold the items for half a year or so but I think it could pay off.

Out of Phase

As Warren puts it; “you should be fearful when others are greedy and be greedy when others are fearful.” This phrase speaks to the idea of setting yourself apart from the rest and positioning yourself for the effects of group think. You want to stay out of phase with what the majority of people are doing. Staying ahead of the curve often means not adopting what everyone else has adopted. Find a unique angle and go with it, don’t model your approach after the market you will be lost in the masses. To read up a bit more on how to set yourself apart check out The Competitive Advantage Spectrum.

The dynamics we are talking about also hold true on the business to business level. Companies that sell out to other companies often do so because they plaid into the masses. By playing into what everyone wants you will water your business down until you find yourself in a financial crisis and in need of someone to bail you out. Pricing wars can quickly lead to this. If a competitor is selling a product for less than what you can make it for you are either in the wrong industry or your competitor won’t be in business long. Dropping your price to meet theirs will only lead them to do the same and ultimately lower the expectation in the customer’s mind of the price for your product or service. This is one of the reasons why I tell all small business owners never to compete on price.

Conclusion

Play your own game. Take the cycles of your industry into account but don’t allow them to shape your business. Just because your customers want to pay less doesn’t mean you need to lower your price. There are many creative ways to meet the coming changes but you will need to step outside of what everyone is telling you and find a unique position that has not yet been exploited.