When starting and running a small business the question of how to finance will come up multiple times. There is often an initial startup cost for assets, materials, and initial operations. As the business grows the demands on your company will change and you will again need to look at acquiring more resources. Depending on your industry the financial barriers will differ but there are some fundamental truths you should adhere to as a small operation.

Importance of Cash Flow

I can’t stress enough the importance of cash flow for your biz. It is the life blood of your organization and without it you won’t last long. You can have all the net worth in the world but if you don’t have positive cash flow your company is worthless. Think of your business like a bucket that has holes in the bottom of it. Your cash flow would be the water pouring in the top while your expenses would be the water pouring out the bottom. Without cash flow your bucket will run dry.

This is a simplistic analogy because in reality you will find that both the flow of water into your bucket and the flow out of the bucket are in constant flux. So much so that your “flow” in will sometimes be more like a drip at the same time your bucket loses its bottom entirely. The ideal circumstance is to have an organization that maintains a constraint positive cash flow and empties its reserves into savings for future market fluctuations.

Little Money in a Dynamic Market

As a small business you fundamentally have to deal with having little money in a market that is constantly changing. Understanding this you would be wise to play into the strengths of small business while at the same time staying conservative with your spending. Small business market places don’t see large sums of constant income; they see peaks and valleys. This comes from seasonality and the inconsistent demand inherent to the market.

To combat this reality it is advisable to find ways to diversify your services and build your customer base. This can be a fine line because you can’t be all things to all people. A landscaping company could do snow removal in the winter, a painter could do both residential and commercial work, or the machinist could create a proprietary product to sell online. The trick it to focus on the company’s core competencies and serve the markets they benefit.

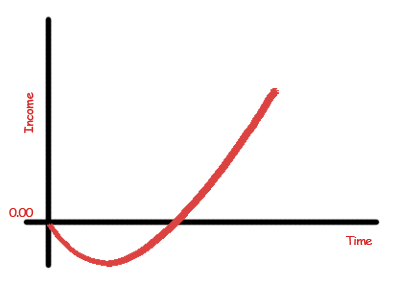

What to Expect the “J” Curve

If you take a step back and look at the gross financial positioning of a successful organization you would see a curve that resembles a J. The J curve implies an initial expense and a gradual return on investment. The rental house I just completed for example required initial finances to purchase and fix. Once rented however the home will produce an income and begin to offset those initial expenses. The point at which you have earned the amount you have invested is your breakeven point. In the case of the rental house it will take many years for the income to offset the expense.

Ideally you will want as quick of a turn as possible but it can take as much as two years or more to recoup your initial investment. As you plan you financing keep this in mind so you have an idea as to when you can expect the initial expenses to stop and when you can expect to see a trend begin in the other direction. Generally all companies get two years. If you are fortunate enough to have made it past two years you will have experienced the majority of the threats your business will ever see.

More isn’t Always Better

There have been studies that suggest that surplus financial capital can be a detriment to startup performance. The reason for this is that the more money one has the less intentional they are with it. Another illustration of Parkinson’s law – expenses expand to fill the budget allocated. This is also one of the reasons venture capitalists assume so much risk when throwing money at a venture. It is also the part of the reason they have “rounds” of funding.

A perfect example of this dynamic is again our rental. I had originally planned on throwing 20 to 30 thousand at the property for the fix ups that were required but found a 6 moth zero % interest credit card with a limit of 8k. I though ok let’s start there and see what happens. Having free money for 6 months is a pretty good deal; if it could cover everything then I could pull a loan out against the house (in its remodeled state) at a great rate and pay the card off. So that is what we did and the 8k limit made us much more intentional with each dollar. We actually ended up just over 7k for all the materials leaving 1k as a buffer for unforeseen expenses.

We could have easily spent 20 or 30k on the project but because we only allocated 8k we made it work. I can think of many instances in which we hunted for a deal rather than purchasing something new at the local hardware store. In fact I think I could write an entire post on “how much we are willing to spend for conveyance”. Shopping at the local habitat for humanity saved us thousands but cost us a little time. We had the time to spend so it was no big deal.

Sources, Where to Find Funding

Now that you have chewed on a few considerations regarding how much funding you may need where should you go to find it? There are a ton of options so I will only touch on my favorite few.

Personal Saving.

If you can save what you need for your business I would suggest you do so. Operating off your own hard earned cash will yield the best return for each dollar spent. It also means that you will have no debt. Having not debt gives you a huge upper hand for obvious reasons.

Family and Friends

Personally I don’t like to mix family and friends with business but this can often be a great way to get started. This is especially true for younger entrepreneurs who don’t have the credit history or income to merit larger formal loans.

SBA

The U.S. Small Business Administration has a few loan programs that may be what you need. You will need to read up on them to see but the idea is they will operate as your advocate to help you receive adequate funding.

Be Self-Reliant

The most successful business men I know will leverage other people’s money but could pay off 100% of their debt if they needed to. If you can get into this position you will be sitting pretty. Banks tend to only lend to those who can prove they don’t need the money so when figuring out how to finance your small business try to be the one that doesn’t need the money.

The borrower is slave to the lender (Proverbs 22:7)

Just wanted to add a note on financing a new startup, I have helped with multiple startup successes recently using the Indiegogo crowdfunding platform.

Crowdfunding can be used to promote something you were going to do anyway, something there is no way to do unless the crowdfunding succeeds, or as a way to add a new business venture to an already successful business. The latter is the most likely to succeed because an already successful business will already know what they are doing as they add a new product or service.

There are literally thousands of crowdfunding campaigns that go nowhere, and if you browse through them you’ll see plenty where a lot of time and effort has gone into the creation of the idea and content. It won’t just fall in your lap. you have to hit the ground running and promote like crazy.

But I thought it worth mentioning as a candidate for a potential funding source, either primary or secondary.